Premier Executive Checking

Our best checking account gives you premium perks

Wire Transfers

Get free incoming wire transfers and two free outgoing wire transfers per year.

Our Best RatesD

Save more on home equity lines and earn more on CDs with preferred rates.

No ATM Fees

Access your money conveniently without being charged an ATM fee.D

Pricing

Skip the monthly fee

Avoid the $50 monthly fee when you maintain a combined daily balance of $50,000 or more in any of these account types.

Benefits

Better banking means fewer limits and more rewards

Unlimited use of domestic ATMs

Get a debit card with higher ATM and purchase limits, no ATM fees, and refunded surcharges.D

No overdraft fee

Automatically cover overdrafts without incurring a fee.D

Our best rates

Save the most with our preferred ratesD on home equity lines of credit and earn more on account balances and CDs.

Credit card rewards

Earn up to 10‚000 bonus points on a new First Citizens Rewards Credit Card for meeting minimum spend requirements.D

Together Card

Teach money management skills to younger family members with a Together Card at no additional cost.D

Free 3x5 safe deposit box

Subject to availability.

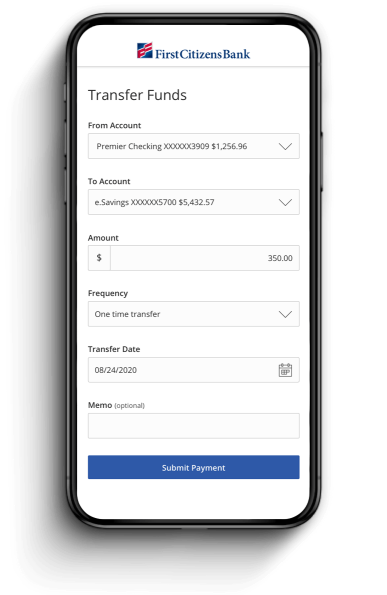

Free external bank transfers

Send money with free external bank-to-bank transfers.D

Payments & Transfers

Instantly move your money wherever you need it

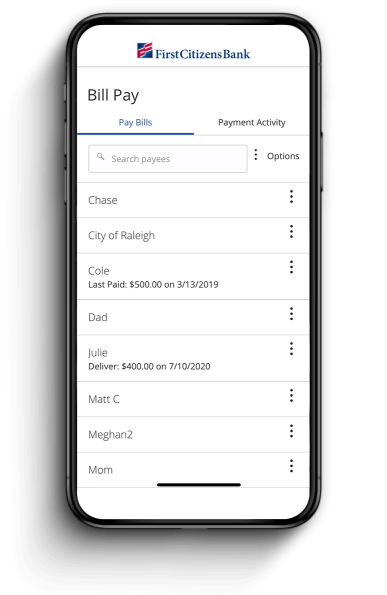

Pay your bills from any device

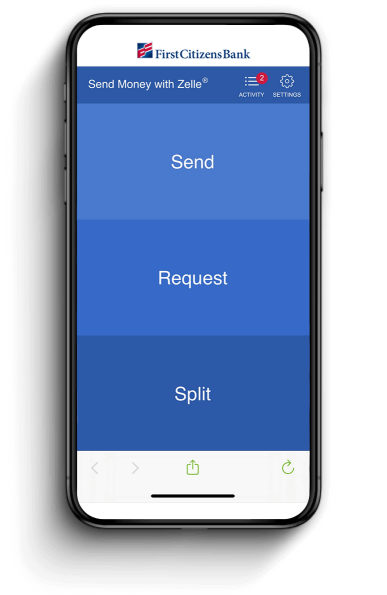

Send money with Zelle®

Transfer funds to other accounts