Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Control your portfolio

Invest how you want, when you want, in real time with Self-Directed Investing.

Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

See how we're supporting companies

We're committed to serving companies as they expand and succeed. The proof is in our success stories.

Q4 Quarterly Market Review: Available now

The Making Sense team reviews changes in the market during Q4 2025.

Retirement should be about pursuing your unique passions, spoiling your grandchildren or buying the vacation home of your dreams—not stressing over how long your savings will last. Knowing how to reduce taxes in retirement is key to preserving as much of your nest egg as possible.

While claiming tax breaks is a helpful starting point, there are other smart moves to consider. Here are nine strategies that can help you reduce taxes in retirement.

Investing in a Roth retirement account is one proven way to reduce taxes on retirement income. Unlike traditional retirement accounts, contributions made to a Roth 401(k) or IRA are after-tax contributions. However, you'll never pay taxes on that money again. Your savings in these accounts will grow tax-free, and you can make tax-free withdrawals in retirement—as long as you meet certain conditions.

Once you turn 50, you're eligible to make catch-up contributions to help boost your retirement savings. In 2024, individuals 50 and older can set aside an extra $7,500 in a 401(k) and $1,000 in an IRA. And starting in 2025, 401(k) catch-up contributions for people between the ages of 60 and 63 will be even more generous—$10,000 or 50% more than the standard catch-up limit for each year, whichever is greater.

The IRS mandates annual withdrawals from traditional 401(k) and IRA accounts once you turn 73—or 75 for those born after 1960. Known as required minimum distributions, or RMDs, these withdrawals are taxed as ordinary income. A large RMD can push you into a higher income tax bracket, increasing the amount of taxes you owe in that year.

However, Roth IRAs and Roth 401(k)s don't require RMDs during the original owner's lifetime. If most of your assets are in traditional accounts, it may make sense to convert some portion of those savings into a Roth 401(k) or Roth IRA before you start taking RMDs. You'll have to pay taxes on the funds in the year you make the conversion, but you'll get all the advantages of a Roth account going forward.

Because of the upfront tax liability, consider all aspects of a potential Roth conversion carefully. Whether this will save you money in the long run depends on many factors, including your tax rate, income level and retirement goals. Consulting a financial advisor or tax specialist is essential.

If you have a traditional IRA but don't need your RMD to fund your living expenses in retirement, you could make a qualified charitable distribution, or QCD, directly from your IRA. You won't be taxed on the distribution, and you'll make progress on your philanthropic giving goals.

In 2024, charitable donors who are 70 1/2 or older can transfer up to $105,000 directly from an IRA to qualified charities. Donors who must take RMDs may apply a QCD against the required amount they must withdraw. This option isn't available for 401(k) accounts, so if you wish to make a QCD, you might consider a rollover IRA.

If you don't claim itemized deductions, you're entitled to a higher standard deduction once you reach age 65. In 2024, if you're 65 or older and filing as single or head of household, you may deduct an additional $1,950 on top of the standard deduction amount. Married couples filing jointly or separately are eligible to deduct an additional $1,550 per qualifying person.

If you decide to itemize your deductions, make sure you're taking advantage of every tax break for which you're eligible, such as tax deductions for homeowners. State sales and income taxes, out-of-pocket charitable contributions and mortgage refinancing points are commonly missed deductions.

Deducting medical expenses is another frequently overlooked opportunity for retirees. To deduct your unreimbursed medical expenses, they'll need to exceed 7.5% of your adjusted gross income, or AGI. However, because older adults often have higher medical expenses and lower incomes than younger taxpayers, this may be an easier threshold to reach as you age. Also, some states have a lower AGI threshold for medical expense deductions, meaning retirees may be able to take a deduction on their state income taxes even if they can't on their federal income taxes.

Plus, make sure you're deducting all medical expenses allowed by the IRS or your state of residence. Even expenses such as acupuncture and health club memberships may be deductible in certain situations.

When you retire, it often makes sense to invest a portion of your portfolio in income-generating investments that aren't taxable or are taxed at lower rates.

For example, interest generated from investments in most municipal bonds is exempt from federal taxes, while interest earned on US Treasury bonds is exempt from state and local taxes. Some real estate investments, such as rental properties, may also have a minimal tax impact because owners can offset rental income with depreciation.

Another lower-tax income investment option is qualified dividend stocks because the income these investments generate is taxed as capital gains rather than ordinary income.

When you withdraw money in retirement, which account you tap into can greatly impact the amount of taxes you owe. For example, one conventional strategy is to withdraw from taxable brokerage accounts first, followed by tax-deferred accounts, such as a 401(k), and tax-free accounts, such as a Roth IRA. This approach allows money in tax-advantaged accounts to grow for as long as possible.

You might also consider tax-loss harvesting to reduce taxes in retirement. This involves selling losing investments in taxable accounts to offset the taxes you'd have to pay on capital gains. If you're considering this approach, consult with a tax and investment professional to avoid triggering the wash-sale rule.

Giving long-term appreciated assets like stocks or bonds that have increased in value directly to charity may help you meet your philanthropic goals—and save on taxes.

Donating appreciated assets means you won't need to pay capital gains taxes on the increased value. Plus, if you itemize deductions on your tax return, you can deduct the fair market value of the assets at the time of donation, which may provide significant tax savings.

Keep in mind that you can deduct up to 30% of your AGI for contributions to a public charity but only up to 20% for donations to a private foundation. Any unused deductions can be carried forward for up to 5 years.

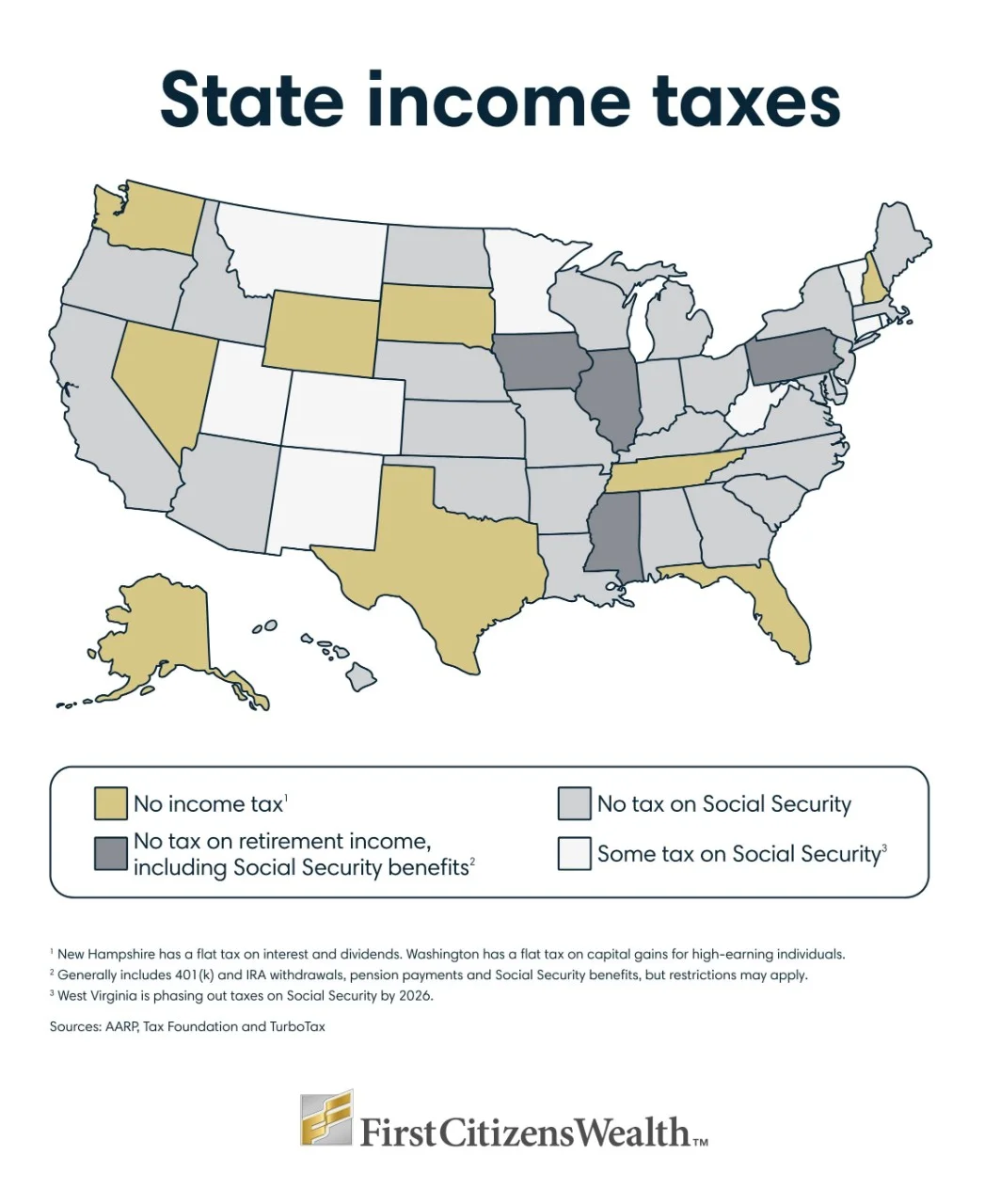

High state taxes can take a big bite out of your nest egg over time. Fortunately, there are states that don't tax income—and some that don't tax retirement income. If you're thinking about moving to another state in retirement, don't forget to factor taxes into your decision.

As of 2024, nine states have no income tax at all. However, these states may impose higher property taxes or sales taxes—and some do tax interest, dividends or capital gains. Another four states tax regular income but not retirement income, which includes the money you withdraw out of your 401(k) or IRA accounts, as long as requirements are met.

1 New Hampshire has a flat tax on interest and dividends. Washington has a flat tax on capital gains for high-earning individuals.

2 Generally includes 401(k) and IRA withdrawals, pension payments and Social Security benefits, but restrictions may apply

3 West Virginia is phasing out taxes on Social Security by 2026.

Sources: AARP, Tax Foundation and TurboTax

While not technically a tax, you'll want to keep the Social Security earnings test penalty in mind if you're still working when you become eligible for Social Security.

If you claim benefits before you reach full retirement age, the Social Security Administration, or SSA, will deduct $1 from your benefit payment for every additional $2 you earn above an annual limit. In 2024, this threshold is $22,320.

In the year you reach full retirement age, the test is more forgiving. The SSA will deduct $1 for every additional $3 you earn above a much higher annual limit—$59,520 in 2024.

The good news is that the annual earnings test goes away in the month you hit full retirement age, and your monthly benefit is increased permanently to account for previous deductions.

Deciding the best ways to reduce taxes in retirement will depend on your goals, the types of accounts you've used for your retirement funds and your overall financial picture. This planning may get complicated, so enlisting the help of qualified professionals is a smart move.

A financial advisor can help you create a holistic retirement income plan—one that meets the needs of your specific situation while also reducing your retirement tax burden.

Nerre Shuriah

JD, LLM, CM&AA, CBEC® | Senior Director of Wealth Planning and Knowledge

Nerre Shuriah

JD, LLM, CM&AA, CBEC® | Senior Director of Wealth Planning and Knowledge

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services and content on any third-party website.

This material is for informational purposes only and is not intended to be an offer, specific investment strategy, recommendation or solicitation to purchase or sell any security or insurance product, and should not be construed as legal, tax or accounting advice. Please consult with your legal or tax advisor regarding the particular facts and circumstances of your situation prior to making any financial decision. While we believe that the information presented is from reliable sources, we do not represent, warrant or guarantee that it is accurate or complete.

Third parties mentioned are not affiliated with First-Citizens Bank & Trust Company.

The information provided should not be considered as tax or legal advice. Please consult with your tax advisor.

Your investments in securities and insurance products and services are not insured by the FDIC or any other federal government agency and may lose value. They are not deposits or other obligations of, or guaranteed by any bank or bank affiliate and are subject to investment risks, including possible loss of the principal amounts invested. There is no guarantee that a strategy will achieve its objective.

About the Entities, Brands and Services Offered: First Citizens Wealth® (FCW) is a registered trademark of First Citizens BancShares, Inc., a bank holding company. The following affiliates of First Citizens BancShares are the entities through which FCW products are offered. Brokerage products and services are offered through First Citizens Investor Services, Inc. ("FCIS"), a registered broker-dealer, Member FINRA and SIPC. Advisory services are offered through FCIS, First Citizens Asset Management, Inc. and SVB Wealth LLC, all SEC registered investment advisors. Certain brokerage and advisory products and services may not be available from all investment professionals, in all jurisdictions or to all investors. Insurance products and services are offered through FCIS, a licensed insurance agency. Banking, lending, trust products and services, and certain insurance products and services are offered by First-Citizens Bank & Trust Company, Member FDIC and an Equal Housing Lender icon: sys-ehl, and First Citizens Delaware Trust Company.

All loans provided by First-Citizens Bank & Trust Company and Silicon Valley Bank are subject to underwriting, credit and collateral approval. Financing availability may vary by state. Restrictions may apply. All information contained herein is for informational purposes only and no guarantee is expressed or implied. Rates, terms, programs and underwriting policies are subject to change without notice. This is not a commitment to lend. Terms and conditions apply. NMLSR ID 503941

For more information about FCIS, FCAM or SVBW and its investment professionals, visit FirstCitizens.com/Wealth/Disclosures.

See more about First Citizens Investor Services, Inc. and our investment professionals at FINRA BrokerCheck.

Treasury & Cash Management

Electronic Bill Presentment & Payment

Investment & Retirement Services

Community Association Banking

Equipment Financing & Leasing

Credit Cards

Merchant Services

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.