Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Joe Koontz

Market Manager, Private Lending

Bill Gibson

Director, Regional Private Banking

When you need to finalize a real estate deal, manage one of life's not-so-little emergencies or pay for a wedding—what's the best course of action to get the cash you need?

If you're tempted to reach for a credit card, you may want to reconsider. There may be other ways to address your personal liquidity needs.

If the amount you need is small and you need it quickly, an easy solution may be the cash in your checking, nonretirement savings accounts or money market funds. Or this might be the right time to use some of the cash in your emergency or rainy-day funds.

Another option for these small, immediate needs is a credit card cash advance. Just remember, while this is an easy way to get cash fast, the interest rates for borrowing from a card tend to be extremely high—often at usury rates of 18% or higher—which might not be the most cost-effective among your short-term financing sources.

If you want to avoid the high rates of cash advances and most of your cash on hand is invested, you may want to explore other options for short-term liquidity.

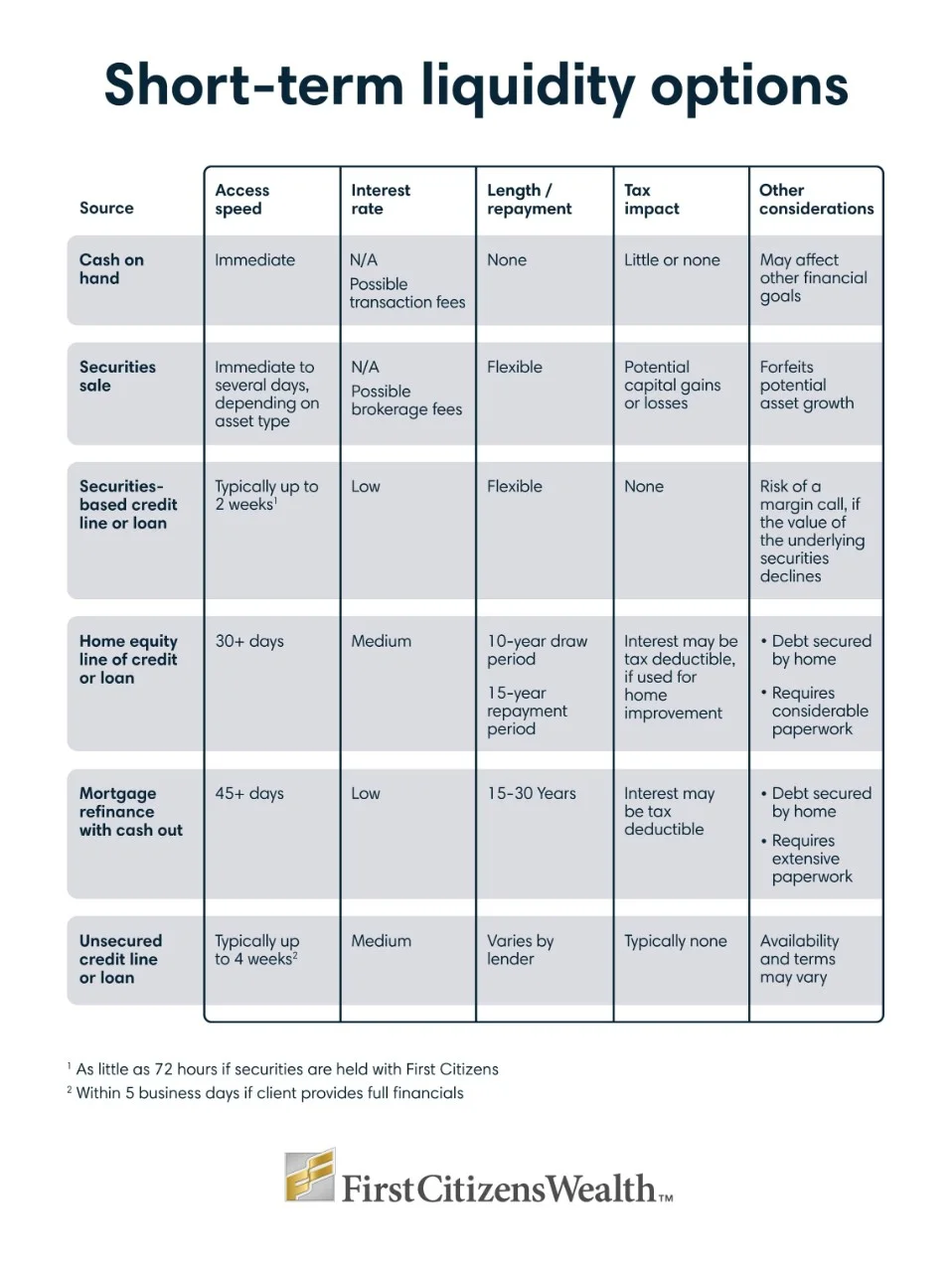

When you consider alternatives to cash and cash advances, it's important to think about how much money you need, how quickly you need it and how much you're willing to pay for it. These three factors can help you evaluate the right option for your situation. Here are a few examples from common short-term liquidity options.

When you're evaluating your short-term liquidity options, don't forget to consider the potential tax consequences, the amount of paperwork, the payback terms—including any penalties for early repayment—and how a particular source of liquidity might affect your other financial goals.

Each of these short-term liquidity options has potential benefits—and possible drawbacks. For instance, using cash on hand or money market funds may affect some of your other near-term financial goals. Selling securities has the potential for a loss of asset growth. And while alternatives like margin accounts and securities-backed lines of credit allow these assets to remain in your portfolio, they are based on the value of your investments. This means you might be required to provide additional collateral or repay the loan immediately if your investments lose a certain value.

Cash on hand, money market funds and unsecured loans typically have little or no impact on your tax situation. However, many of the other short-term liquidity options are more complex and nuanced. For example, selling securities could mean you're responsible for capital gains taxes, and the interest payments on HELOCs may be tax deductible if the proceeds are used for home improvements. You should consult an accountant or tax advisor for help with your specific situation.

Depending on the reason you need short-term liquidity, utilizing multiple sources might be a good option. Here's an example that outlines how using two sources of liquidity could help a young couple purchase real estate in a highly competitive real estate—where paying cash for the property and closing quickly might give them an advantage.

There are many sources of cash to meet short-term liquidity needs and many combinations of sources that might be used to create timely, cost-effective solutions. To determine a potential source for your situation, remember the three important characteristics of accessing cash—amount, speed and cost. Then consider factors like the impact on other financial goals, potential drawbacks and tax considerations.

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.