Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Invest how you want, when you want, in real time with Self-Directed Investing.

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

We're committed to serving companies as they expand and succeed. The proof is in our success stories.

2026 Market Outlook video: Available now

The Making Sense team reflects on 2025 and discusses key headwinds and tailwinds for 2026.

It might be one of the most common questions financial planners and advisors get. "At what age can I retire?" But it's a tough answer to nail down. Financial planning for retirement has many moving parts.

To get started, however, it's a good idea to identify approximately how much you'll need to save to retire comfortably—and the progress you've made toward that goal. While the dollar figure will vary depending on the life you envision in retirement and your life expectancy, you can follow rough guidelines to assess your current financial situation.

Determining when you can retire involves more than taking a peek at what you've saved in your retirement accounts. You'll need to have a clear picture of where you financially stand today to ensure the most accurate planning. Either on your own or in conjunction with your financial advisor, it's relatively easy to run the numbers on your savings and income streams.

Before you know whether you'll have enough money saved to retire—the key factor in determining when you can retire—you need to have an idea of what your dream retirement looks like. Here are some areas to think about so you can better understand what you'll need your retirement savings to cover when you make the big leap.

Once you have both your net worth and rough retirement plan in hand, it's time to set some benchmarks for your retirement savings to keep you on track for your ideal retirement age.

As a general rule of thumb, many financial planners assume that a typical retiree will need to spend about 80% of their pre-retirement income to maintain a comfortable lifestyle, although the percentage you'll need may be higher or lower. While Social Security and pensions will cover part of your anticipated retirement spending, you should consider how much you may need to withdraw from your retirement savings to fund your lifestyle and ensure that you won't run out of money.

Fidelity has developed a set of rough benchmarks for retirement savings targets by age, estimating that most people will want to maintain their pre-retirement lifestyle. Of course, your calculations may be different based on the design and cost of the retirement you're envisioning.

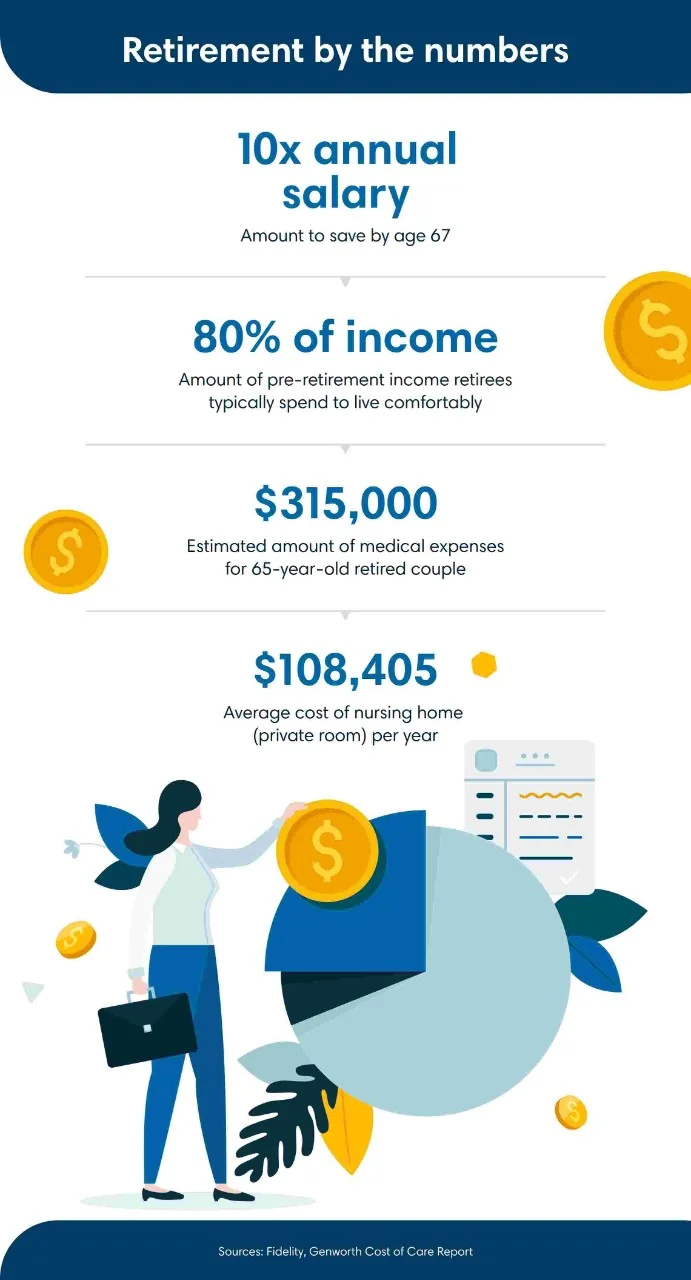

Based on research from Fidelity and the insurer Genworth Financial's annual Cost of Care Report, your retirement may look something like this.

If your savings amount is behind the target figure, you can work with your financial advisor to develop a strategy to increase your savings or reduce potential future retirement expenses. If you're ahead of the game, you can consider accelerating paying off debts, creating a taxable investment account for additional savings or even working on your wealth transfer plans early.

Knowing when you can retire is truly about having a plan. The sooner you can craft a plan that aligns with your dream retirement age, the better you'll be able to cope with life's curveballs along the way. And once you have a plan in place, don't forget an annual financial checkup to make sure you stay on track. You and your dream retirement both deserve the extra attention.

Your investments in securities and insurance products and services are not insured by the FDIC or any other federal government agency and may lose value. They are not deposits or other obligations of, or guaranteed by any bank or bank affiliate and are subject to investment risks, including possible loss of the principal amounts invested. There is no guarantee that a strategy will achieve its objective.

About the Entities, Brands and Services Offered: First Citizens Wealth® (FCW) is a registered trademark of First Citizens BancShares, Inc., a bank holding company. The following affiliates of First Citizens BancShares are the entities through which FCW products are offered. Brokerage products and services are offered through First Citizens Investor Services, Inc. ("FCIS"), a registered broker-dealer, Member FINRA and SIPC. Advisory services are offered through FCIS, First Citizens Asset Management, Inc. and SVB Wealth LLC, all SEC registered investment advisors. Certain brokerage and advisory products and services may not be available from all investment professionals, in all jurisdictions or to all investors. Insurance products and services are offered through FCIS, a licensed insurance agency. Banking, lending, trust products and services, and certain insurance products and services are offered by First-Citizens Bank & Trust Company, Member FDIC and an Equal Housing Lender icon: sys-ehl, and First Citizens Delaware Trust Company.

For more information about FCIS, FCAM or SVBW and its investment professionals, visit FirstCitizens.com/Wealth/Disclosures.

See more about First Citizens Investor Services, Inc. and our investment professionals at FINRA BrokerCheck.

This material is for informational purposes only and is not intended to be an offer, specific investment strategy, recommendation or solicitation to purchase or sell any security or insurance product, and should not be construed as legal, tax or accounting advice. Please consult with your legal or tax advisor regarding the particular facts and circumstances of your situation prior to making any financial decision. While we believe that the information presented is from reliable sources, we do not represent, warrant or guarantee that it is accurate or complete.

Third parties mentioned are not affiliated with First-Citizens Bank & Trust Company.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services and content on any third-party website.

First Citizens Bank is a Member FDIC and an Equal Housing Lender icon: sys-ehl.

NMLSR ID 503941

Treasury & Cash Management

Electronic Bill Presentment & Payment

Investment & Retirement Services

Community Association Banking

Equipment Financing & Leasing

Credit Cards

Merchant Services

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.