Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

We all think of Social Security as central to retirement income. The average person receives about $1,700 per month, although this amount varies widely.

But what happens to these benefits when you or an immediate family member passes? We've brought in Gregory Wesley-Shanks, a wealth paraplanner at First Citizens Investor Services, to shed light on how Social Security benefits can extend beyond your life and support your loved ones.

From the day you begin paying into it, a portion of the taxes collected for Social Security is set aside to provide a form of life insurance for your spouse and dependents. This segment of the fund is referred to as Social Security survivor benefits.

"Survivor benefits are one of the pillars of the fund, even if a lot of people aren't familiar with them," Wesley-Shanks says. "There are a few conditions that decide the presence and status of benefits from case to case, but overall there are two determining factors: the deceased's work history and the number of hours they've accumulated from their benefits in the form of credits."

The more years you work and pay into the fund, the more credits you'll have and the larger the benefit your loved ones will have access to. While the number of years you'll need to work to cross the minimum credit threshold for benefit activation varies with your age at the time of death, anyone working at least 10 years is eligible for survivor benefits.

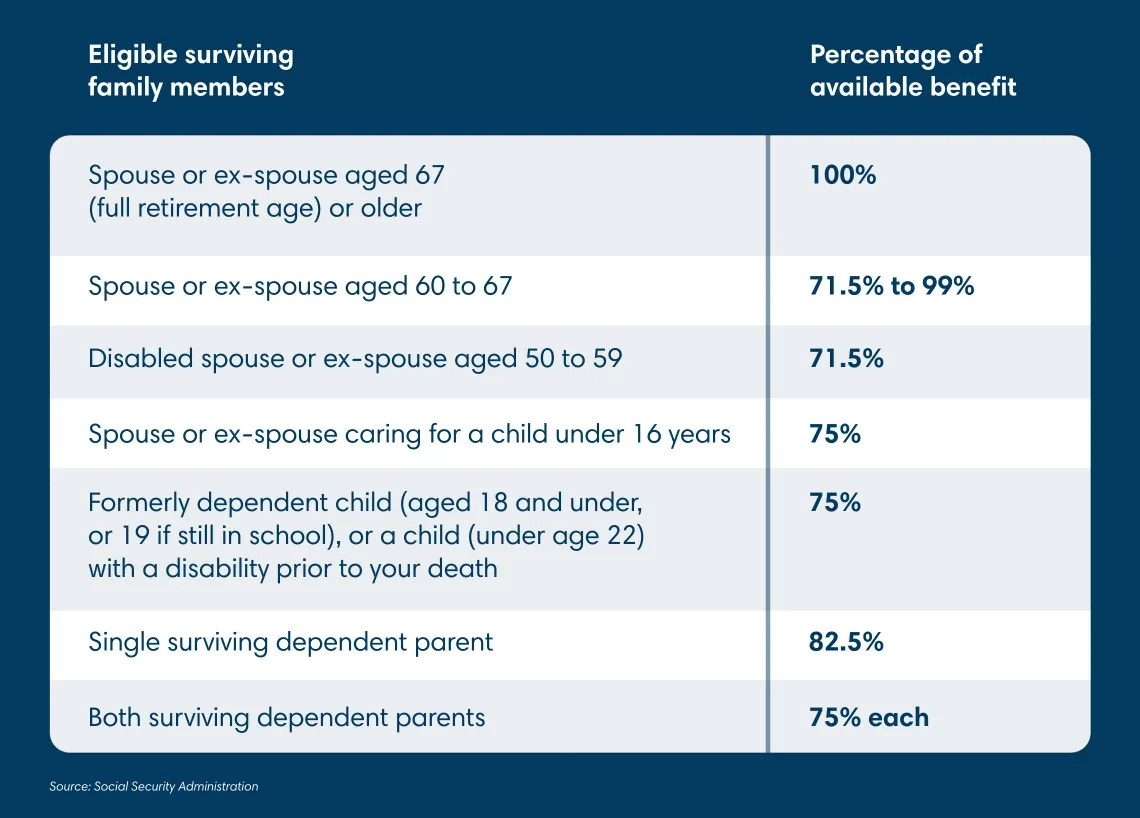

If you've met the work requirements needed for activation, certain family members will be eligible to collect your survivor benefits in the event of your death. "In addition to your spouse and ex-spouse, any dependent children under a certain age and parents that are over the age of 62 and dependent on your income can apply and may qualify," Wesley-Shanks says. "But the percentage of benefits they receive will vary."

The family member with the most straightforward claim to your Social Security survivor benefits is your spouse—and, in certain cases, ex-spouse—once they reach age 60. For current spouses, the only requirement for qualifying is being married for 1 year. Ex-spouses need to have been married to you for a period of 10 years before age 60, or age 50 if you were claiming Social Security disability benefits prior to death. Even if an ex-spouse remarries after age 60, they can still claim survivor benefits for your account, which can lead to a situation where current and ex-spouses can claim simultaneously.

"It's not uncommon to have multiple survivor benefits within a family," Wesley-Shanks says. "But beyond a certain number of people accessing the benefit, the amount that can be drawn for each claimant within a single household caps out under the maximum family benefit."

According to the Social Security Administration, the percentage of available benefits are as follows:

Survivor benefits can be claimed even if the person making the claim is working, although the benefit amount may be reduced based on the survivor's age and earnings. But someone already receiving their own Social Security benefits can't claim survivor benefits unless the benefits are higher than what they currently receive.

"Once you're old enough to claim your own Social Security benefits, you'll have to pick between it and survivor benefits because you can't take both," Wesley-Shanks says. "Like the retirement aspect, if you wait until 67 the payment amount increases annually. Work out in advance which has the highest payout, because if delaying survivor benefits works out to a larger sum than delaying your own Social Security, you'll want to take it first, and vice versa."

When you receive benefits, you should also factor in potential taxes. The amount you pay is determined by a calculation of combined income. Combined income is defined as your adjusted gross income, or AGI, plus nontaxable interest, plus half of your Social Security benefits. If you file as a single individual, your Social Security benefits aren't taxed if your combined income is below $25,000. If your combined income is between $25,000 and $34,000, 50% of your Social Security benefits are taxable. Lastly, if your combined income is greater than $34,000, 85% of your Social Security benefits are taxable.

The combined income numbers that determine the taxable percentage of your Social Security benefits are higher if your tax filing status is married filing jointly. In this case, the tax on 50% of Social Security income applies if your combined income is between $32,000 and $44,000, and the tax on 85% kicks in above $44,000. Also keep in mind that children may also be subject to taxes on their benefits if they hold trust accounts or brokerage funds, Wesley-Shanks notes.

Payment of survivor benefits isn't automatic. If you or a loved one plan to collect them, you'll need to go through a formal application process.

"You can apply by phone, at a Social Security Administration office or online," Wesley-Shanks says. "No matter which method you use, you'll get a notice about any potential dangling retirement accounts or pensions you have from previous jobs that have been reported. If you're using the Social Security Administration website, you can look through W-2s and use their tools to calculate projected benefit totals."

The documents you'll need to claim benefits include:

"For certain other circumstances, like claiming on the basis of disability for dependents, other documents may be required," Wesley-Shanks says. "And if you or loved ones need help understanding the paperwork or filing process during a time of loss, you'll be able to go into a Social Security Administration office by yourself or with an advisor to work with a representative on your claim."

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.