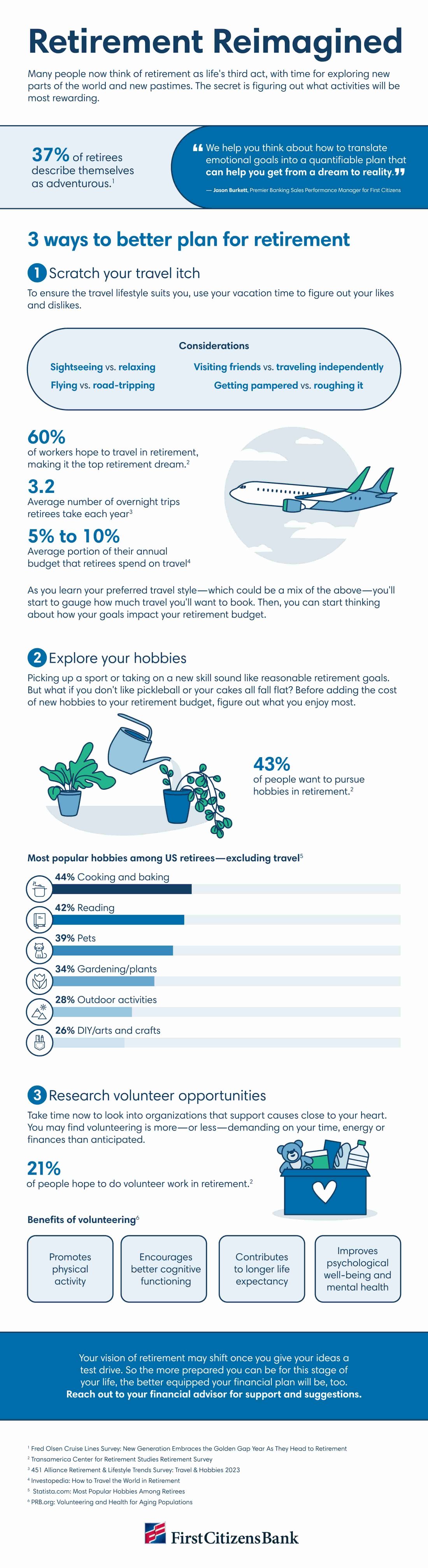

Many people now think of retirement as life's third act, with time for exploring new parts of the world and new pastimes. The secret is figuring out what activities will be most rewarding.

37% of retirees describe themselves as adventurous.1

"We can help you think about how to translate emotional goals into a quantifiable plan that can help you get from a dream to reality." – Jason Burkett, Premier Banking Sales Performance Manager for First Citizens

3 ways to better plan for retirement

1. Scratch your travel itch

To ensure the travel lifestyle suits you, use your vacation time to figure out your likes and dislikes.

- Sightseeing vs. relaxing

- Flying vs. road-tripping

- Visiting friends vs. traveling independently

- Getting pampered vs. roughing it

As you learn your preferred travel style—which could be a mix of the above—you'll start to gauge how much travel you'll want to book. Then, you can start thinking about how your goals impact your retirement budget.

- 60% of workers hope to travel in retirement, making it the top retirement dream.2

- On average, retirees take 3.2 overnight trips each year.3

- On average, retirees spend 5% to 10% of their annual budget on travel.4

2. Explore your hobbies

Picking up a sport or taking on a new skill sound like reasonable retirement goals. But what if you don't like pickleball or your cakes all fall flat? Before adding the cost of new hobbies to your retirement budget, figure out what you enjoy most.

43% of people want to pursue hobbies in retirement.2

Most popular hobbies among retirees—excluding travel5:

- 44%: Cooking and baking

- 42%: Reading

- 39%: Pets

- 34%: Gardening/plants

- 28%: Outdoor activities

- 26%: DIY/arts and crafts

3. Research volunteer opportunities

Take time now to look into organizations that support causes close to your heart. You may find volunteering is more—or less—demanding on your time, energy or finances than anticipated.

21% of people hope to do volunteer work in retirement.2

Benefits of volunteering6:

- Promotes physical activity

- Encourages better cognitive functioning

- Contributes to longer life expectancy

- Improves psychological well-being and mental health

Your vision of retirement may shift once you give your ideas a test drive. So the more prepared you can be for this stage of life, the better equipped your financial plan will be, too. Reach out to your financial advisor for support and suggestions.

1 Fred Olsen Cruise Lines Survey: New Generation Embraces the Golden Gap Year As They Head to Retirement

2 Transamerica Center for Retirement Sudies Retirement Survey

3 451 Alliance Retirement & Lifestyle Trends Survey: Travel & Hobbies 2023

4 Investopedia: How to Travel the World in Retirement

5 Statista.com: Most Popular Hobbies Among Retirees

6 PRB.org: Volunteering and Health for Aging Populations