Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

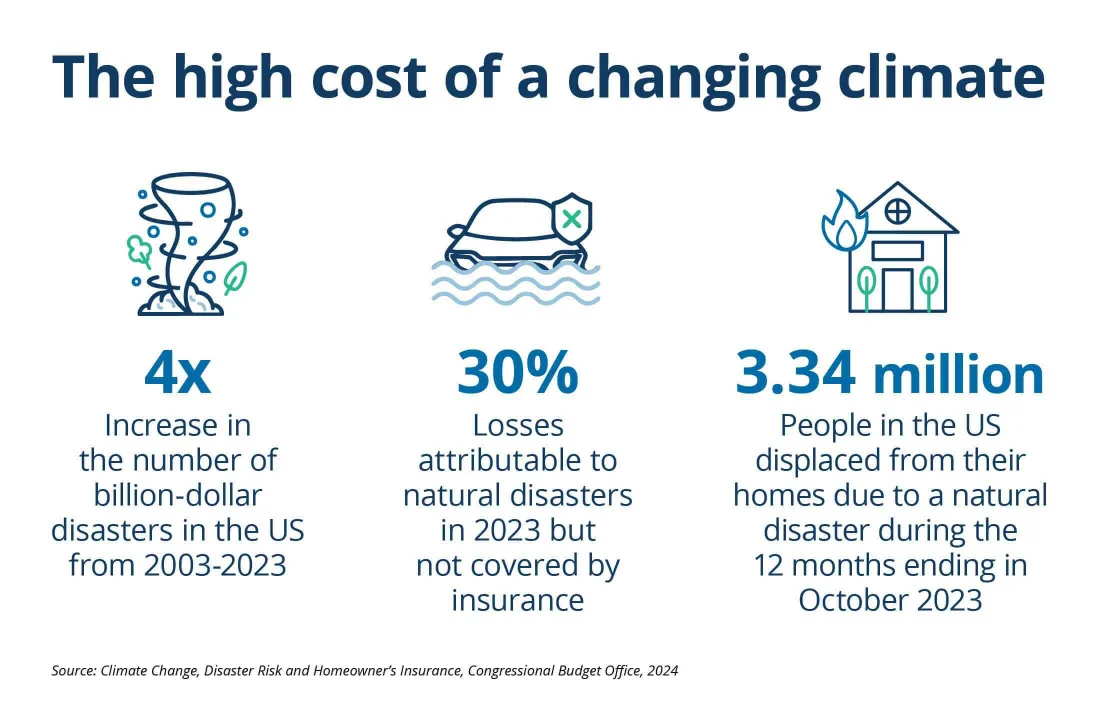

Whether it's hurricanes in the Southeast, wildfires in the West or tornadoes in the heartland, millions of Americans and their businesses, homes or families are affected annually by natural disasters.

Such events are becoming more frequent—occurring three times more often than they did 50 years ago, according to the Food and Agriculture Organization of the United Nations.

Natural disasters take an emotional and physical toll, and they can cause long-term financial effects. Fortunately, you can take steps—both before and after a disaster hits—to help minimize the financial damage. With help from some First Citizens experts, here are some insights on how to prepare for the next unpredictable climate event and how to recover when a natural disaster takes place.

Standard homeowners insurance policies cover some—but not all—damage caused by certain natural disasters, and it's common for homeowners to misunderstand their coverage. Read through your policy, or check with your agent to flag any coverage gaps.

"My recommendation is that every insurance policy deserves a review at least every couple of years," says Ann Bass, manager of personal lines sales and service at First Citizens Insurance Services. "There are several new coverages available that can be added to a homeowners policy, provided you have an insurance company that offers the additional coverage and an agent who's keeping up with current coverage and carrier changes."

If you live in an area prone to certain events like flooding from hurricanes or damage from earthquakes, you might want to consider an additional policy or a policy rider that's specific to such disasters. You may also want to consider a separate flood insurance policy through the National Flood Insurance Program or through private flood-coverage markets.

Given the increasing severity of storms, it may be advisable to consider adding flood coverage even if you're not in a federally designated high-risk zone. Such zones are based on the historic likelihood of flooding, which can easily be exceeded by today's behemoth events.

After disaster strikes, it can be hard to accurately remember everything you own as you figure out what's been damaged or lost. The easiest way to create an inventory of your belongings is to walk through your home and take pictures of labels or serial numbers of high-value items. You can also download the home inventory app from the National Association of Insurance Commissioners, which will walk you through the inventory creation process.

Setting aside at least 6 months of living expenses in a liquid account is a good rule of thumb for anyone—and the aftermath of a natural disaster is exactly when such a fund is needed. Calculate your rainy day savings so you know how much you'll need. This can give you some breathing room and flexibility if you need to pay for lodging or repairs before insurance money comes through, or if you're out of work following a disaster.

The first thing to do when a natural disaster hits—after you've taken care of any medical needs—is to take steps to prevent additional damage. If you need to purchase tarp to cover roofs or materials to board up windows, or if you need to hire a remediation expert, be sure to take pictures of the damage and immediately start the process of protecting your property. Be sure to save your receipts of these purchases for future reimbursement.

Here are additional steps to take after you've dealt with the immediate threat of further damage.

Reach out to your agent or home and auto insurer to file a claim. They're typically inundated after disaster strikes, so the earlier you can get the ball rolling, the better. If your property sustained a lot of damage, expect the insurer to send an adjuster to make an in-person inspection and provide a coverage estimate.

If you live in a federally declared disaster area, you can visit DisasterAssistance.gov to fill out an application for assistance from the Federal Emergency Management Agency. You may also qualify for assistance from your state emergency management agency or local nonprofits, which may set up shelters or provide vouchers for supplies.

If you believe you'll have trouble making payments on mortgages, car loans or other debt, contact your lender as soon as possible. They may have options, such as a hardship or forbearance program, that can suspend or temporarily lower your payments until you're back on your feet.

Make sure you're reaching out to your mortgage servicer—the company you send your monthly payments to—which may be different than the lender you originally worked with. Plan to contact your lenders as soon as possible, ideally within 60 days after the event.

"Waiting is one of the biggest mistakes people make," says Karen Duff, senior director of collections at First Citizens. "If customers don't reach out to let us know they're facing financial difficulty due to disaster-related challenges and the loan remains in past-due status, after a period of time elapses foreclosure or auto repossession could be initiated. Communicating with lenders as soon as possible is the best advice."

Once an insurance settlement is reached, you may receive an insurance check made out to both you and your mortgage servicer. At First Citizens, if the check is for less than $40,000, the bank will endorse it and return it to the customer. If it's for more, they'll distribute it in stages throughout the rebuilding process.

While it's common to want to get back to normal as quickly as possible after a disaster, rebuilding may take longer than you'd like. Expect delays both in finding contractors and securing necessary materials.

"We do inspections along the way, and we typically disburse those proceeds in thirds," says Brian Kunar, director of mortgage servicing at First Citizens. "We want to ensure that the collateral secured by our note is returned to its pre-damage value."

Here are some tips to help facilitate the process.

Unfortunately, natural disasters may bring out scammers looking to take advantage of others' misfortunes. Your insurance carrier will more than likely have a list of preferred contractors for remediation, repairs and replacement. You can choose your own, or your carrier can help you decide if you're unsure about a contractor's reputation. A contractor's work may also be guaranteed if your carrier recommends them.

Either way, spend extra time vetting potential contractors and other workers before moving forward. Scammers know you're in a hurry to repair your property, so be particularly cautious of any who promise they can get to work immediately—especially if they ask for money before the work starts.

If you used a mortgage forbearance program, you'll eventually have to pay back the missed payments. However, your lender may offer a loan modification or allow you to defer your payments so you don't have to simultaneously reimburse all of your missed payments.

Once you start to regain your financial footing, start putting money back into an emergency fund so you'll be prepared the next time disaster hits. While you can't prevent a tornado or avalanche, being financially prepared for such an event can make the recovery slightly less stressful.

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.