Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Community Benefits Plan applications submitted after November 1 will be reviewed for the following calendar year.

Invest how you want, when you want, in real time with Self-Directed Investing.

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

We're committed to serving companies as they expand and succeed. The proof is in our success stories.

2026 Market Outlook video: Available now

The Making Sense team reflects on 2025 and discusses key headwinds and tailwinds for 2026.

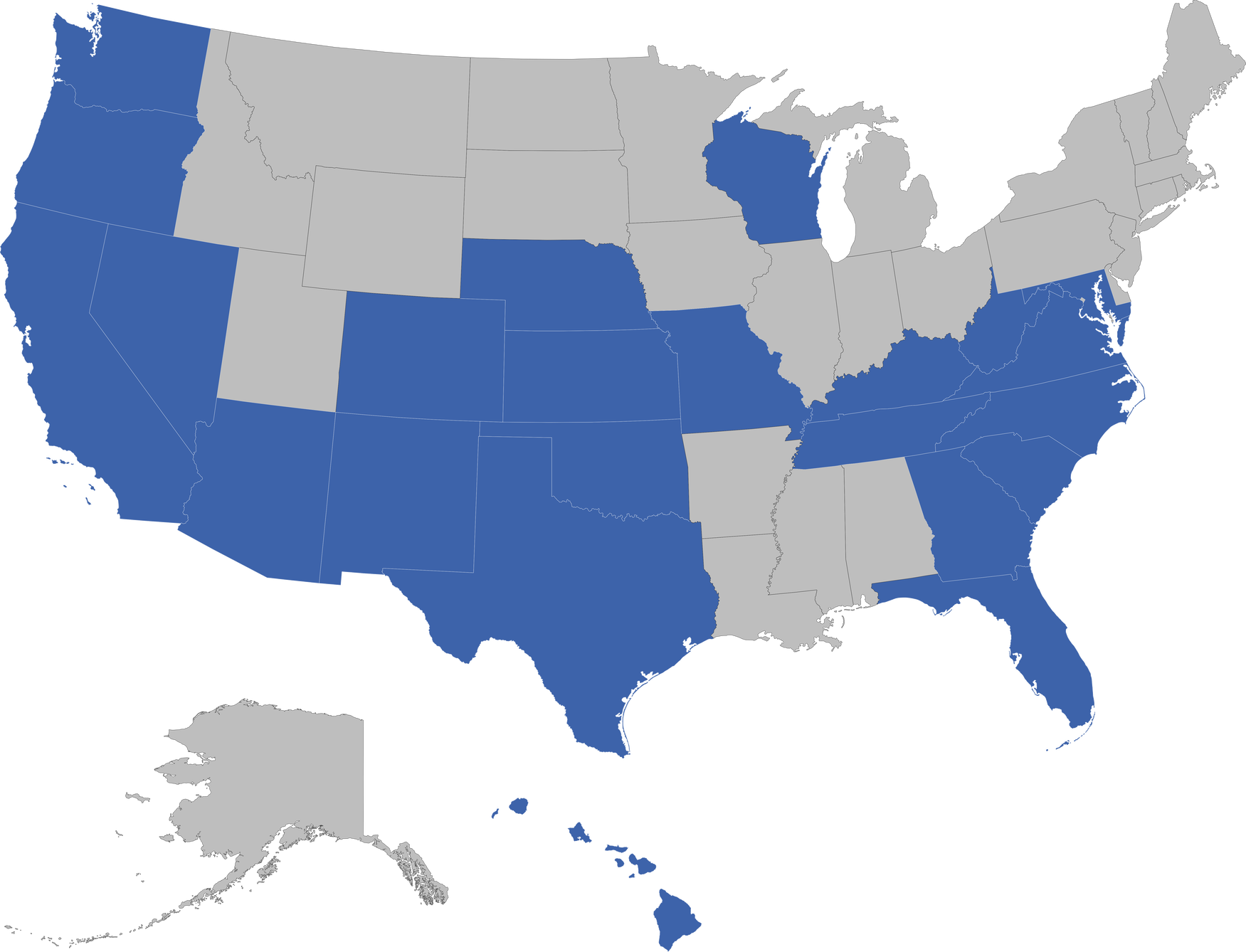

We're proud to announce a $16 billion, 5-year Community Benefits Plan that builds on our ongoing work to reinvest in low- and moderate-income (LMI) communities and neighborhoods of color. This plan will help increase our investment in the cities and towns we serve and help grow vibrant and diverse communities and businesses.

Through 2025, our Community Benefits Plan will focus on lending to and investing in LMI neighborhoods with regular input and feedback from a group of community experts.

$6.9 Billion

for Community Development Lending, or CDL, and investments

$3.2 Billion

for mortgage loans

$5.9 Billion

for small business loans

In addition, the plan provides for $50 million Community Reinvestment Act (CRA)-qualified philanthropic giving through 2025.

Our goal is to provide lending, investments and services that reflect the needs of our local communities. We accomplish this by increasing our investments and spending in low- to moderate-income communities and through CRA-qualified nonprofit grant funding. We offer CRA-qualified grants to benefit nonprofit organizations that support affordable housing, economic self-sufficiency and business growth in the communities we serve.

Please make sure you review our funding priorities, grant process and eligibility criteria before submitting a grant funding request.

The creation of a CBP agreement between a bank and community groups is used to facilitate specific lending, service and investment commitments by the bank in its communities. In this case, we've partnered with NCRC (National Community Reinvestment Coalition) to create a plan, which will ultimately serve to increase the flow of funds into low- and moderate-income communities and provide a forum for underserved communities to express their needs.

Overall, the First Citizens plan enhances the support we already provide to our communities today. It's also consistent with other active plans in the industry.

After a thoughtful annual planning process and coordination with community partners, we extend grant invitations to organizations focused on our priority areas of strategic community development throughout the year.

Our priority areas include:

Once your online form is submitted, the information is processed for Community Reinvestment Act (CRA) qualification. Unfortunately, due to the volume, we ask that you allow us 60 days to provide a response.

CRA-qualified grant amounts vary by market and organization size. If you've previously received a First Citizens grant, an amount in that same range is a good starting point. While there are local variations, as a general guide, grant amounts in larger markets can range from $5,000 to $50,000. Grant amounts in smaller markets can range from $2,500 to $25,000. Amounts less than $5,000 will be managed by our local market representatives.

We'll fund an organization no more than once in a calendar year. Rare exceptions apply. As you choose a specific community development purpose on the form, consider which program or service is your highest priority for funding. If you're requesting general operating support, select the community development purpose that most closely aligns with your organizational mission.

We've incorporated an environmental concentration into our grant process to the extent that if an organization's work connects with employment or community development, it can be considered for funding.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services and content on any third-party website.

Bank deposit products are offered by First Citizens Bank. Member FDIC and an Equal Housing Lender. icon: sys-ehl.

NMLSR ID 503941

Treasury & Cash Management

Electronic Bill Presentment & Payment

Investment & Retirement Services

Community Association Banking

Equipment Financing & Leasing

Credit Cards

Merchant Services

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.

First Citizens is proud to invest in the communities where we live and work. We've developed strong partnerships with nonprofit organizations to address issues fundamental to economic resilience and social progress in low- and moderate-income communities. Our focus is on improving the lives of individuals and families by investing in workforce development, financial education and homebuyer/homeowner counseling.

We also seek to strengthen the resiliency of our communities by addressing the needs related to affordable housing, small business and neighborhood revitalization. We recognize that people and communities of color continue to face significant challenges, and we're working to advance racial equality and economic opportunity throughout many of our partnerships.

To be considered for a local grant, your organization:

The following organizations are not eligible for funding:

We partner with a wide range of national and local nonprofit organizations that align with our strategic community development priorities: