Digital banking for business

Seamlessly access all of your accounts from one place with First Citizens Digital Banking for business.

Cannabis business financing opportunities are evolving rapidly.

Whether you're new or experienced in the cannabis industry, it's important to consider funding options that may help your growing business. Here are some financing options to consider and potential challenges to look out for.

Although the cannabis industry has grown considerably in recent years, it's no secret that many significant challenges exist for businesses operating in this space.

In the US, ongoing regulatory and legal hurdles add to the issues experienced by new business owners in any industry. Another challenge is finding and securing financing for growing cannabis businesses.

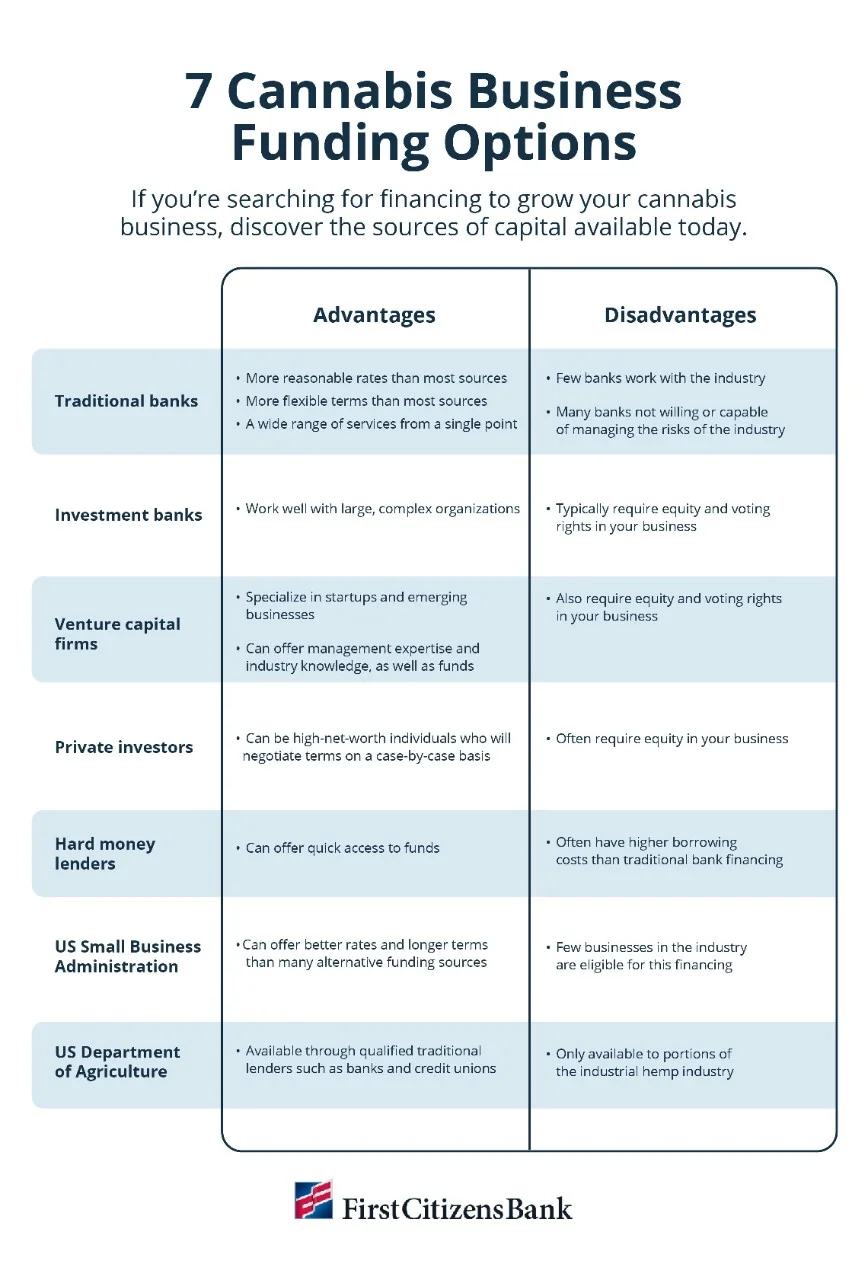

By examining the various sources of funds available to cannabis companies and exploring the pros and cons of each option, you can be better prepared to navigate today's financial waters. Here's an example of current funding options, plus their advantages and disadvantages.

When searching for financing to fund cannabis businesses, there are two broad options: traditional bank financing and an eclectic selection of private and public sources of funds.

In the US, traditional banks are the most used source of financing for personal and business purposes. They offer a convenient selection of business services from a single source—including business savings, checking, credit cards, lines of credit, payroll services and treasury management services, as well as cash flow-based business financing.

Of the various business financing options, traditional banks typically offer the most reasonable rates and terms for the businesses that qualify for their services.

Investment banks help facilitate more complicated financial transactions such as mergers and acquisitions, strategic partnerships and large-scale capital raises through outside investors. They typically provide underwriting services to large organizations that are interested in raising capital to grow.

Outside investors provide the capital in exchange for a portion of equity ownership in the company seeking funding. Equity typically includes a financial stake, as well as voting rights that give investors a say regarding how the company is managed.

Venture capital firms traditionally focus on providing funds to startup and emerging businesses that show promise for significant growth. Beyond their financial involvement, venture capitalists often support startup companies by providing business management expertise, technical capabilities and industry knowledge.

Like investment banks, financing from venture capital firms is offered in exchange for a significant portion of equity—or financial and voting rights—in your company.

Private investors are another source of funds for growing cannabis businesses. They can be people or organizations that make investments in cannabis businesses or simply high-net-worth individuals or businesses themselves.

The common trait private investors share is a desire for healthy returns on their investments, frequently in the form of equity in the cannabis companies receiving their funds.

Hard money or bridge loan lenders offer short-term financing that requires the borrower to use real estate or another form of collateral to qualify for loans. These collateral-based loans are often used for real estate transactions but may be used for other purposes. Hard money loans can offer quick access to funds but usually have a higher borrowing cost than traditional bank financing.

Loans backed by the US Small Business Administration, or SBA, are more traditional and based on collateral. They typically offer better rates, longer terms and more lenient requirements than many other sources of business financing.

SBA term loans are available through qualifying lenders such as banks, credit unions and other financial institutions. The challenge with these loans is the current limitations the SBA places on cannabis businesses.

At the moment, there's more opportunity for hemp businesses to qualify for SBA loans. If you own a hemp business, visit the SBA's website to help determine if you qualify.

Like SBA loans, loans from the US Department of Agriculture, or USDA, are guaranteed by the federal government and available through traditional lenders such as banks and credit unions. Loans of this nature are typically available to businesses in rural areas.

If your business operates in the industrial hemp space and needs financing, this avenue is worth exploring. For the latest information on these types of business loans, visit the USDA's business programs website.

Business financing offered by traditional banks has several advantages over many of the other lending options available to businesses today. Traditional bank financing typically offers more flexible term lengths, giving new businesses more freedom to manage their cash flows and repayment schedules.

More reasonable interest rates offered by traditional banks also allow business to grow without being burdened with high interest expenses. The range of financial services offered through most banks can also act as a central portal to help new businesses standardize their financial systems and processes with integrated checking, savings, credit and cash management products.

Traditional bank financing can also eliminate many of the burdens associated with nonbank lending options, such as:

Given the advantages of traditional bank financing, it's not surprising that growth-oriented cannabis businesses have been drawn to this avenue for their capital needs. However, there may be some potential hurdles to pursuing traditional bank financing for your organization.

When you locate a bank willing to provide financing to cannabis businesses, it pays to understand the qualification and loan processes upfront.

Typically, there are a few broad factors involved when qualifying for cannabis business financing.

If you're a startup lacking multiple years of financials to qualify for a traditional loan, you still have options for funding your business.

There are avenues to explore at this early stage, such as friends and family loans and self-funding. You may also consider the collateral-based financing approaches from hard money lenders because they can offer quick approvals and less paperwork than traditional business financing, although this funding source usually has a higher borrowing cost than a bank.

First Citizens offers traditional bank financing to cannabis businesses. Unlike other financing sources, we don't charge premium rates to our cannabis business clients. When you qualify for a business loan with us, you're treated like any other business client seeking capital to grow.

For example, if your business has the proper financials, you can apply for our financing solutions. Once approved, your business can access all the lending products we offer.

If you're a hemp business interested in financing options, we're a preferred SBA lender with SBA-guaranteed programs available for businesses that qualify. As a lender with an understanding of the industry, we value our cannabis clients and can provide value beyond financing needs. Once you become a client, you have access to our long-standing cannabis business expertise, market experience and regulatory understanding.

Our specialists can work with your legal and accounting teams to help you navigate the industry and concentrate on business growth. We consider ourselves long-term partners with our cannabis business clients and a part of the core business team alongside your attorneys and CPA.

In addition to our financing products, you can take advantage of our full suite of business and personal financial services, such as our deposit products, cash management services, mortgage solutions and personal wealth management services.

As an organization immersed in the growth of a wide range of cannabis businesses, we'd like to see more financial institutions support the industry moving forward. To realize this kind of progress, participating banks may need to develop the comprehensive systems, safeguards and expertise necessary to address the fast-changing nature of this dynamic industry.

For more information regarding cannabis business financing, connect with a cannabis banking specialist today.

Email Us

Please select the option that best matches your needs.

Customers with account-related questions who aren't enrolled in Digital Banking or who would prefer to talk with someone can call us directly.