2023 Small Business Survey Results

Getting a pulse on the small business market

Opportunities and challenges lie ahead for small business

First Citizens strives to be a trusted partner to businesses throughout our communities. We recently conducted our ninth annual small business survey—expanding the pool from 5 to 10 states across the country—to assess the motivations, sentiments and successes of small business owners across the country. We hope you find the learnings as interesting and valuable as we do.

How are small business owners feeling?

79%

Almost 8 out of 10 small businesses are somewhat or very confident they'll experience growth in the next year.

48%

At the same time, just under half of business owners are hopeful economic conditions improve over the next 2 to 3 years.

68%

More than 2/3 of small business owners say they've experienced success over the past year, similar to 2022 survey results.

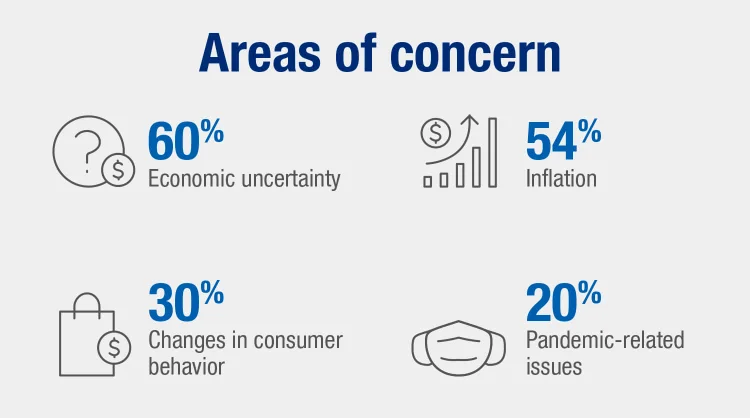

60%

However, there's a 9% increase over last year's survey in the amount of small business owners concerned about growth.

How are they funding expansion efforts?

"To see confidence of this caliber feels incredibly promising. As a bank, we're eager to help small business owners sustain their positive positioning in the market, leading to further innovation and growth nationwide."

Doug Sprecher

Executive Director of Sales Strategy at First Citizens

What concerns them about the future?

Which states participated?

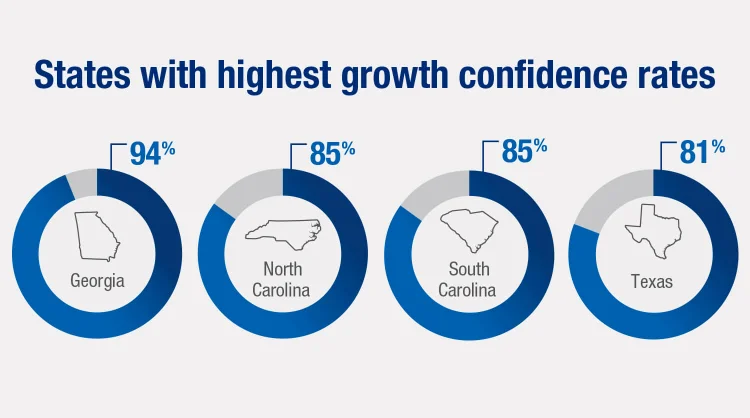

Confidence by state

This year's survey included responses from business owners in Arizona, California, Colorado, Florida, Georgia, North Carolina, South Carolina, Texas, Virginia and Wisconsin.

Confidence is strongest among Georgia-based owners, 94% of whom feel secure in their businesses' likelihood to grow. North Carolina and South Carolina owners expressed strong assurance in their ability to grow their business, with each state capturing 85% growth confidence. Texas rounds out the top 4 most confident states, with 81% stating they are optimistic about next year's growth.

At the same time, confidence in the near-term economy remains low across all states surveyed. South Carolina and Wisconsin have both seen a 26% decrease in near-term economic confidence since 2021, with just 39% of the former and 30% of the latter feeling hopeful. Arizona expressed the lowest degree of confidence in near-term conditions at 26%.