Personal Insights

Explore insights for your lifestyle

Your 2026 tax bracket road map

Learn to address scams targeting elders

When is buying a house better than renting?

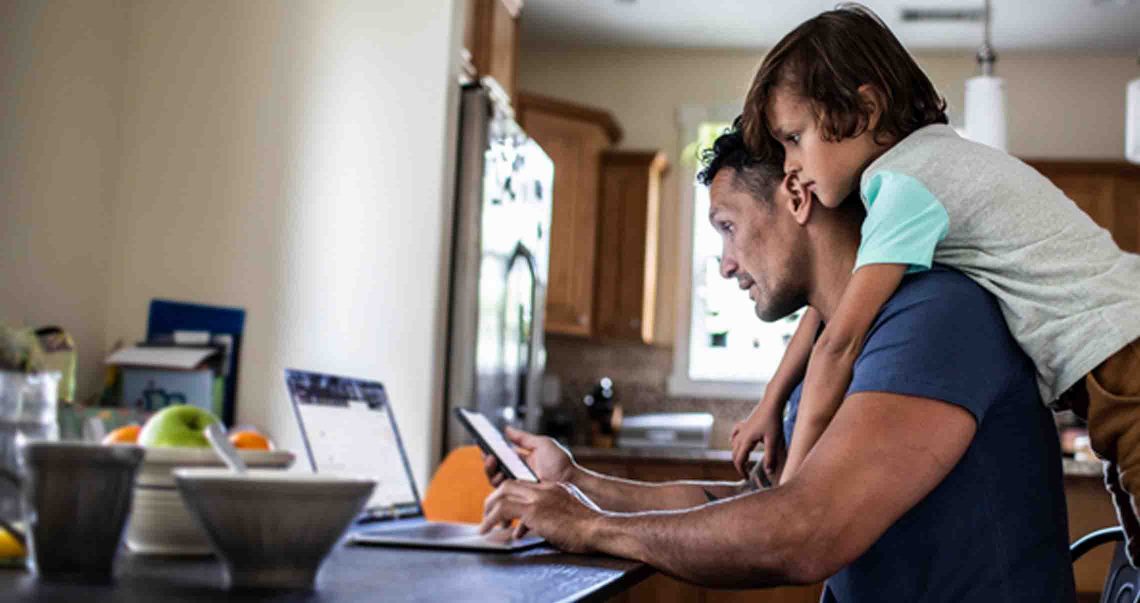

Financial planning for new parents

End-of-year financial planning checklist

How does having a child affect taxes?

Know the difference between a Roth and traditional IRA

Understanding the 2025 home market

How to plan for retirement

Financial checklist: 8 steps for new parents

Financial planning guide to buying a house

Is a rollover IRA right for you?

How to lower insurance premiums as disasters rise

Tips to ease retirement fears

Comparing retirement plans for the self-employed

What can a trust do for you?

Showing 1 - 16 of 297 results