Home Equity Loans

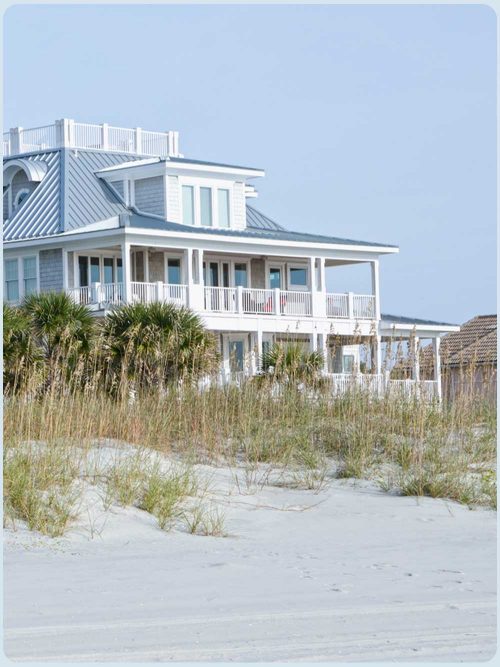

Funding your dreams starts at home

Unlock the potential of your home's built-up equity

You've invested a lot of equity in your home over the years. A home equity loan can help you tap into this value and use it to achieve your goals.

Access to funds you need

Lump-sum funds are available for specific needs.

No surprises

Fixed monthly payments make for predictable monthly budgets.

Flexible terms

Home equity loan terms are available from 5 to 15 years.D

Let us help you make the most of your home's equity

Rates as low as

6.80% APRD

Get quick, easy access to the funds you need

For a backyard pool

For home renovations

For a large purchase

Let your home fuel your goals

Transform your home's equity into funds that help you achieve your goals.

How to get started

If you're unsure how to open a home equity loan, don't worry. First Citizens is here to guide you and make each step as simple as possible.

Submit your application

The first step toward opening a home equity loan is starting a conversation with one of our expert bankers and submitting an application for pre-approval.

Underwriting and appraisal

Once you've submitted your application, we'll work with you to gather and review important documents. This can include a credit report, personal financial information and a home appraisal.

Get final approval

In this phase, an underwriter reviews all documentation to complete final approval. Your banker will communicate final approval to you.

Prepare for closing

Before closing, we'll contact you to discuss and review your loan approval. You'll review disclosures, discuss expected fees, provide any additional documentation needed and verify the closing date.

Closing

Finally, you'll sign documents to officially open your home equity loan.