Premium Business Money Market Account

Increase your savings with tiered interest rates

Save more with a business money market account

With our premium business money market savings account, the higher your balance, the greater your interest income. You'll need to be an existing First Citizens Business Customer with a Business Digital Banking login in order to open an account.

Increase savings

Tiered interest rates increase along with your account balances.

Earn interest

Interest is compounded every day on the daily collected balance.

Bank on your time

Access Digital Banking for business solutions from anywhere.

Maximize your savings

Higher balances receive higher interest, helping you maximize your liquid savings with any business money market account you open.

Convenience without costs

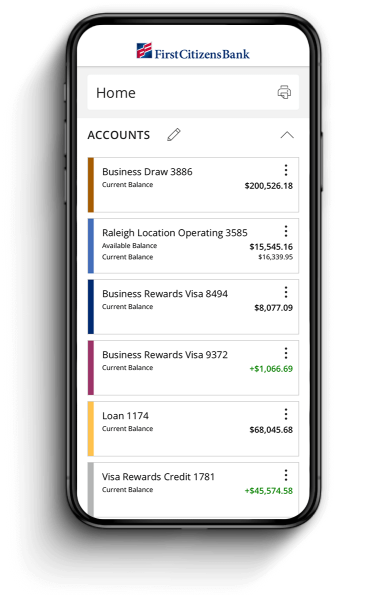

Online and mobile access

Access Digital Banking for business solutions from anywhere.

Pay with confidence

Your Visa® Business Debit Card offers a safe, convenient way to pay for purchases, manage cash flow and increase efficiency—all for free.

More options

Get unlimited use of any First Citizens ATM or branch in our network—for free.D

FDIC insured

Your business money market account is FDIC insured up to applicable limits.

Manage your business on the go

Manage your accounts from anywhere

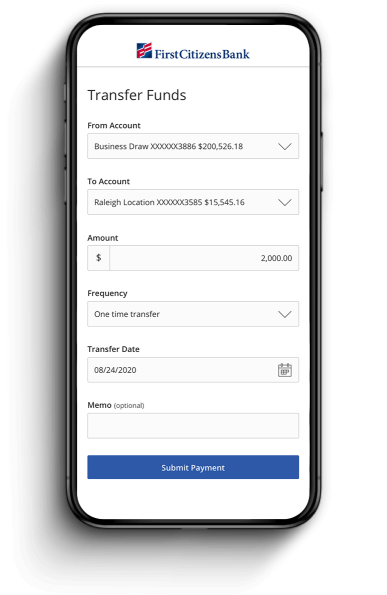

Send and transfer money using ACH and wires

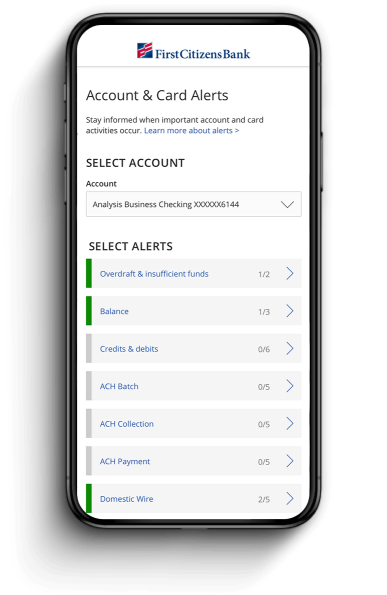

Receive account and security alerts